Table of Content

Also, in the past, you could typically do more than one state return as long as it is the same state. I had my taxes done before by a "professional" and must say the Turbo Tax experience was much more satisfying. Despite what any tax prep service on-line or otherwise might claim they are not going to get you out of a jam with the IRS. The best strategy - "honesty is the best policy" - no joke. Along those lines, Turbo Tax does have a very nice feature which checks your return for IRS "red flags" and gives you a rating as to how likely your return is to be audited. I don't know how accurate it is but it is comforting.

Was severe and Turbo Tax has pledged not to repeat this ploy. Deluxe or Premier should work quite well for them. Considering how much one can save in taxes using Turbo Tax the typical price on eBay is a steal. If you are not sure how much you should be paying do a search for different levels of Turbo Tax and use the "completed listed" option to see what they are going for.

Sage 50 Pro Accounting 2022 1 User Full Retail Version

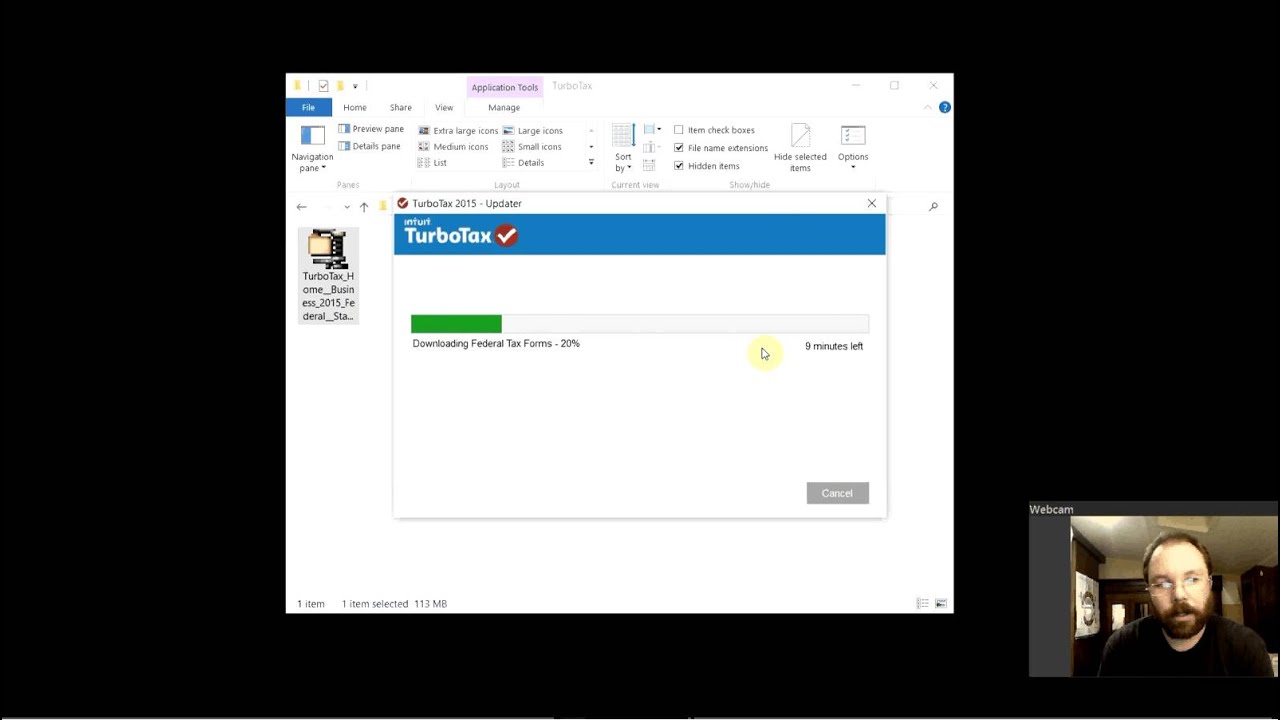

I owed money to the State, so e-Filing was really almost a waste of time. If you have a simple tax return, you can file with TurboTax Free Edition, TurboTax Live Assisted Basic, or TurboTax Live Full Service Basic. Free filing is only available in certain products. Internet connection and acceptance of product update is required to access Audit Defence.

Does not include GST/HST and other non-income tax audits and reviews unless the issues are ancillary to the income tax review itself. Includes field audits through the restricted examination of books, but does not include the "detailed financial audit". If not 100% satisfied, return within 60 days to Intuit Canada with a dated receipt for a full refund of purchase price. Claims are based on aggregated sales data for all NETFILE tax year 2021 TurboTax products. That means that the state return has to printed and mailed, rather than efiled.

Turbotax 2015 home and business mac software#

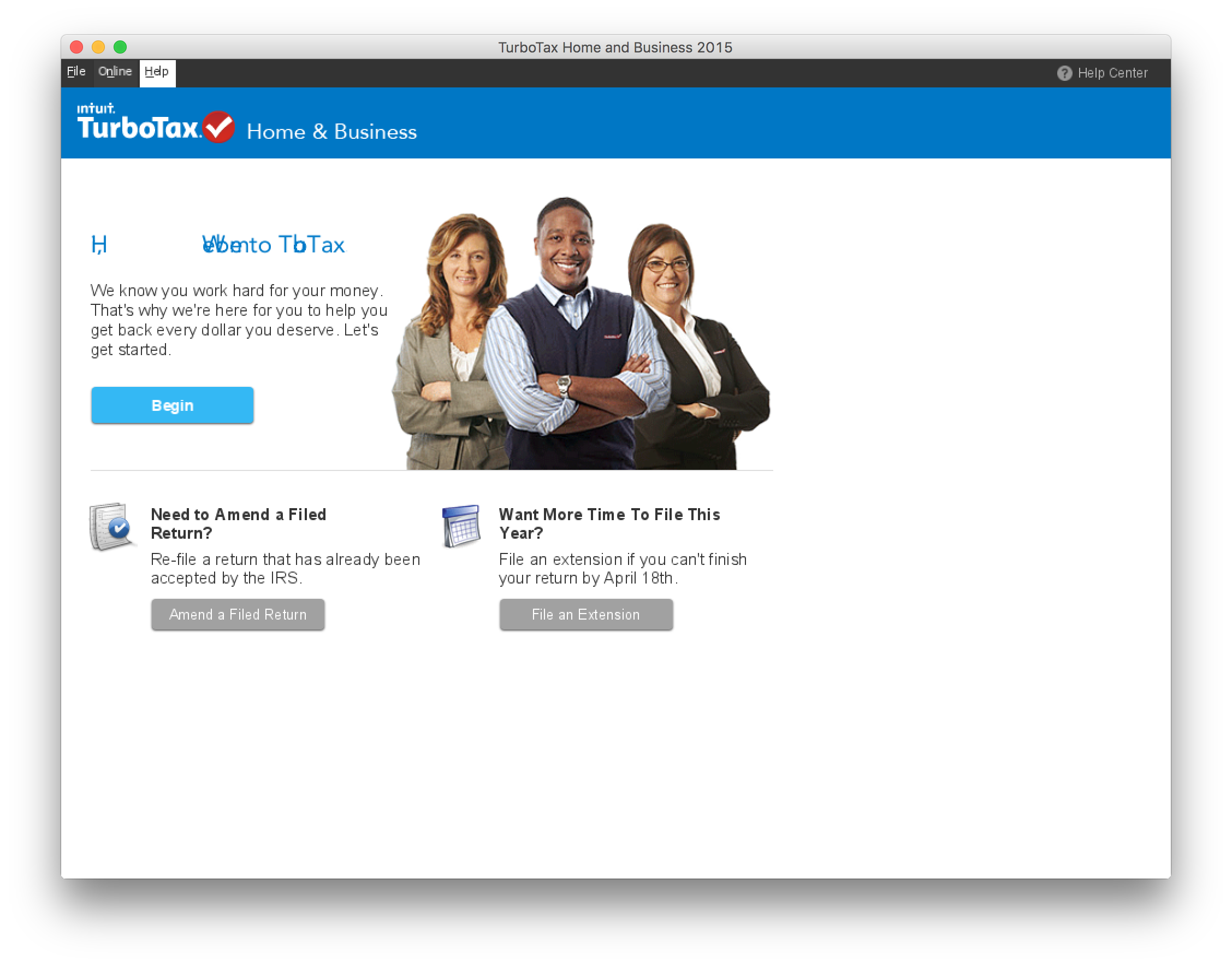

You will find everything needed for your corporation or partnership taxes. TurboTax can help find you any new tax deductions and credits. Or hand it off start to finish—let’s get your taxes done right. This is a new, never used, fully registrable 2015 TurboTax Home & Business Federal + State + 5 Federal Personal Efiles and ItsDeductible software package.

Support availability subject to occasional downtime for systems and server maintenance, company events, observed Canadian holidays and events beyond our control. We only sell authentic and original products and we offer money-back guarantee for any product we sell. Over the past 5 years, more than 24M returns have been electronically filed with TurboTax based on CRA NETFILE reporting. To file 2021 taxes, please select a TurboTax product. You can file taxes for a different year by selecting the year above. We’ll find every tax deduction and credit you qualify for to boost your tax refund.

H&R Block Tax Software Premium 2022 -PC/Mac [Key Card Box with Free Ship]

If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the amount paid for our software. TurboTax Free customers are entitled to a payment of $9.99. Audit Defence and fee-based support services are excluded. This guarantee cannot be combined with the TurboTax Satisfaction Guarantee.

DO NOT BE FOOLED. The IRS does not operate like that. The IRS will initiate contact via a letter and follow up with a phone call. You should follow up ANY contact from the IRS will a phone call to the IRS. That is, you call the IRS and ask if they contacted you. Make sure you have a legitimate IRS phone number. Get the name and number of the agent you spoke with.

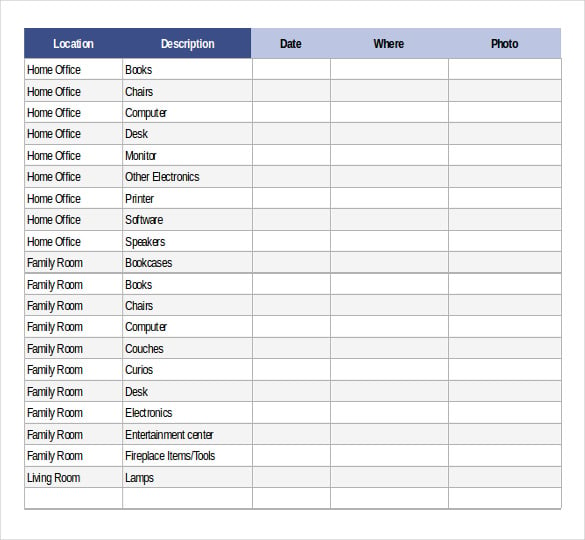

Many people are uncomfortable buying anything but a "new" package but I have had very good luck with "once used" packages. Most importantly make sure what you are buying has what you are expecting. For example not all packages have Federal + State + Federal eFile which is what I look for. State eFile is not, in my opinion, worth the extra money as you can simply print out the state form and mail it in or take it in your local County/City office.

This makes TurboTax a good companion product to Quicken. In previous years, one had to export sdAnd, once you have made the associations between Quicken and the Tax forms, each year gets easier. I will note that the instructions for e-Filing were a little vague, and I was unsure of what to send to the State.

If you plan on sharing your Turbo Tax with friends and relatives make sure that you have enough "files" in your package. If you are buying a used package one or more may have been used. You also need to be aware of the number of e-files you are entitled to.

He went over my taxes with me over the phone and found another error I made. I expect this was an unusual IRS encounter but, needless to say, I was relieved and happy. One final note, regardless of how you file your taxes there are numerous scam artists out there who can sound very threatening and very convincing. They may have some convincing personal information and will threaten you will jail time if you do not pay-up immediately.

Trending price is based on prices over last 90 days. Save turbotax home business 2015 to get e-mail alerts and updates on your eBay Feed. If you pay a penalty or interest due to a TurboTax calculation error, we will reimburse the penalty and interest.

TurboTax Online prices are determined at the time of print or electronic filing. All prices are subject to change without notice. Not because anything had changed, but because it imported all my stuff from Quicken directly.

Certainly if Turbo Tax showed a high probability of audit I would be very cautious and perhaps go back and ease up on a few deductions if possible. You have to weigh the few bucks you may be gaining through a questionable deduction to the hassle of an IRS audit. I once neglected to check a couple of boxes I should have and got a letter from the IRS and eventually a call from an IRS agent.